Three decades of making ‘Main Street America’ great. So why are CDFIs under attack?

We believe that all impact-minded folks should know about the role of CDFIs in bolstering “Main Street”, the nature of the current attack, and the advocacy efforts to save the sector.

Acronyms under Assault: a snapshot and what you can do

A snapshot of how the current administration is attempting to undermine DEI, the EPA/Parks Service/Forest Service, USAID and ESG and what you can do

Evaluate Your Social Connection: A 6-Point Checklist

It is evident to me that loneliness and the decline of social connection and trust are driving many societal outcomes today. As we sift through the post-mortems of what went wrong in the US Presidential election, we must acknowledge that polarization is driven, in part, by eroding social trust, with only 32% of people in our country trusting each other.

Our Business: 2024 in Review

As the year comes to a close we have been reflecting on our second year operating as a Registered Investment Advisor. Throughout 2024, we sought to grow our firm and expand the quality and depth of our offerings. We forged 16 new client relationships, hosted three major cross-community gatherings, created 10 original blogs and 11 (going on 12) unique monthly newsletters - all informed by our learnings at 25+ community events and engagement with local partners.

Study your ballot & Statewide Initiatives in WA

Study your ballot ahead of election day for state and local races and initiatives.

Guest Blog by Cary Moon & Dionne Foster: Building Political Infrastructure

A guest blog written by Cary Moon & Dionne Foster, Executive Director of Progress Alliance

In this moment of political instability, some of us are seeking more effective ways to invest our resources and energy for lasting progressive change. Supporting great candidates is of course essential. But what if we could build sustainable progressive power in our state, rooted in a more inclusive democracy that represents all our communities?

What if we had the infrastructure in place year round to organize vision and collaboration around solutions – instead of just a flurry of activity at election time?

A Time for Hope in Action

Hope alone is not a strategy. But as a verb, hope gives me a belief in what is possible. Rather than seeing the current state of the world as impossible for me to do anything about, hope provides the optimism, clarity and strength to do something rather than nothing. A starting point to move beyond stasis.

50+ years of Pride & what you can do NOW!

In the spirit of Seattle Pride 50, we encourage you to get involved and support LGBTQ+ rights, initiatives and businesses this month – and all year round. Here are some key resources to get you started.

Is Your 401(k) Climate Friendly?

Probably not. While your 401(k) retirement savings are essential for your financial security, they might also be inadvertently contributing to environmental harm. Many 401(k) plans invest in oil and gas companies, which not only affect the planet but can also impact your investment returns.

Decoding the EPA’s $27 Billion Investment in Greenhouse Gas Reductions

Curious about how the EPA's $27 billion dollar investment in greenhouse gas reductions will roll out? This blog is designed to demystify the historic Greenhouse Gas Reduction Act (GGRF).

Humanizing real estate investments

Humanize Wealth provides personalized wealth management for individuals, families, and foundations who value social impact, environmental justice and shared prosperity. To best guide folks along their investment journey, we are continuously learning and informing ourselves on the landscape of real estate investment opportunities that seek to create shared prosperity in our region and beyond.

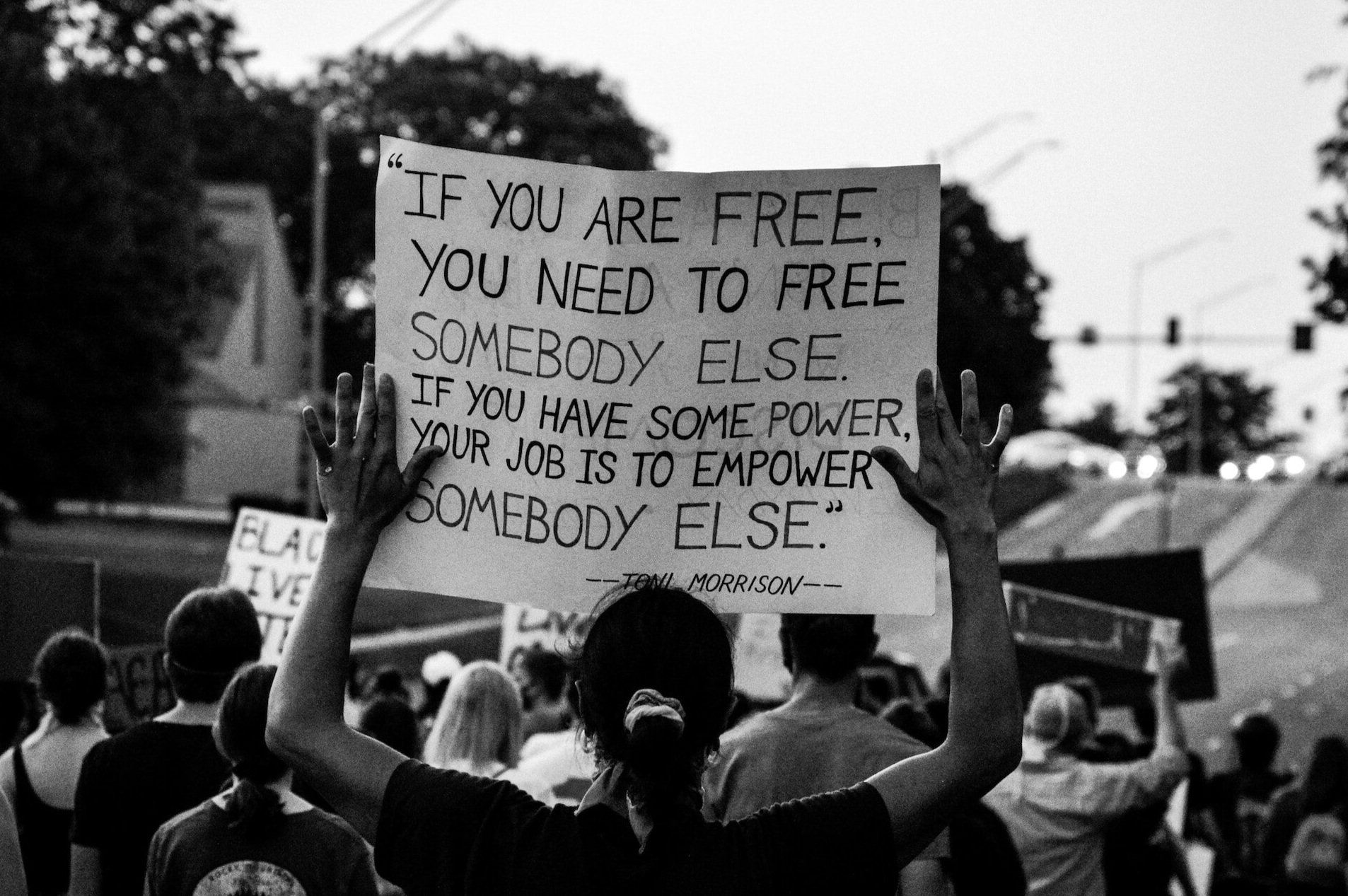

Learning Black History inspires me to be a Good Ancestor

With February being Black History Month, I’ve taken time to reflect back on what I have learned about Black history over the last few years, how it has transformed my worldview and how I spend my time and energy differently today as a result.

Why we Gather underpins the Way we Gather

Looking into 2024, we seek to humanize our industry events and community gatherings by getting to the heart of real issues, seeking to understand different needs and perspectives, and co-creating solutions. We also seek to be a bridge across communities of investors, artists, businesses, philanthropists, community development folks, public agencies, etc.

Donor Advised Funds: a Philanthropic & Investment Multi-Tool

DAFs are an important tool for investors seeking to use their financial resources to foster positive change across various economic, social and environmental systems from climate change to education, housing, biodiversity and even politics.

Are you using your change-making power?

Consider the power of your investment dollars as a tool for progress.

No, ESG is Not the Devil Incarnate

Why use of Environmental, Social and Governance (ESG) investment factors and analysis across the overwhelming majority of investment strategies will not only survive, but increasingly thrive