Decoding the EPA’s $27 Billion Investment in Greenhouse Gas Reductions

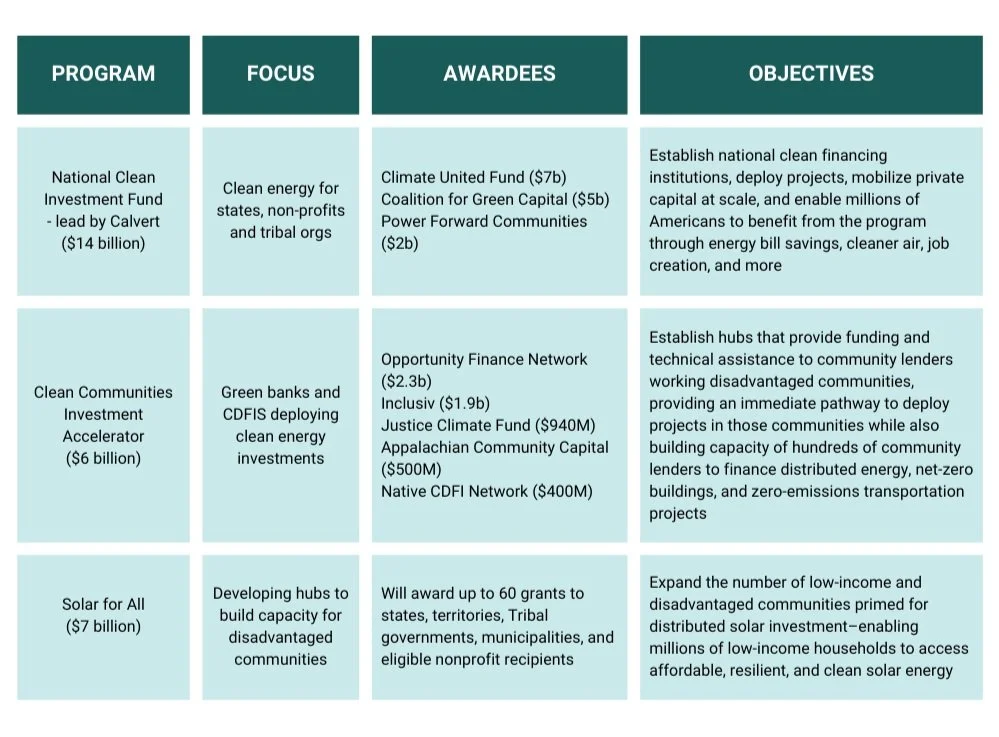

Earlier this month, the Biden-Harris Administration announced recipients for $20 billion in grants to mobilize private capital in delivering climate solutions to communities across America. The grants fall under two competitions within the historic Greenhouse Gas Reduction Fund (GGRF), with $14 billion now selected for the National Clean Investment Fund (NCIF) and $6 billion for the Clean Communities Investment Accelerator. The GGRF totals $27 billion, with $7 billion still waiting to be awarded. Deploying these funds for clean energy installations will help meet President Biden’s climate goals of reducing greenhouse gas emissions by 52 percent below 2005 levels by 2030.

The GGRF was created under the Inflation Reduction Act as part of President Biden’s “Investing in America” agenda with the goal of creating a national clean financing network for climate solutions across sectors. These dollars are essentially a down payment on a broader plan to empower existing lenders to scale up their work while encouraging more lenders to finance similar climate projects across the country. It is the single largest non-tax investment within the Inflation Reduction Act to build a clean energy economy.

The grants are unique in that they seek to address climate change while also centering low-income and disadvantaged communities - which often bear the brunt of environmental degradation yet receive the least financial support. In its initial press release, the EPA stated:

By financing tens of thousands of projects, this national clean financing network will mobilize private capital to reduce climate and air pollution while also reducing energy costs, improving public health, and creating good-paying clean energy jobs in communities across the country, especially in low-income and disadvantaged communities.

The selected applicants have committed to driving significant impact toward the program’s objectives and will reduce or avoid up to 40 million metric tons of climate pollution per year. The program’s stated objectives include:

Reduce greenhouse gas emissions and other air pollutants

Deliver the benefits of greenhouse gas- and air pollution-reducing projects to American communities, particularly low-income and disadvantaged communities

Mobilize financing and private capital to stimulate additional deployment of greenhouse gas and air pollution reducing projects

The grantees will mobilize almost $7 of private capital for every $1 of federal funds - leveraging public dollars for significant private-sector investment. The EPA estimates that these lenders will mobilize a total combined public and private investment of $150 billion. The GGRF serves as a clear example of public-private collaboration towards more sustainable outcomes.

Via the National Clean Investment Fund, nearly $7 billion was awarded to Climate United, a national nonprofit coalition focused on delivering the benefits of green technologies to communities across the county. The coalition is composed of Calvert Impact, the Community Preservation Corporation (CPC), and Self-Help Credit Union. Climate United seeks to deliver cleaner air, quality jobs and increased energy security. The organization has committed to deploying “at least 60 percent of funds in low-income and disadvantaged communities, at least 20 percent in rural communities, and at least 10 percent in Native communities”.

It’s worth noting that worldwide, banks still make an average of $513 billion in loans every year to the fossil fuel industry, with behemoth U.S. banks leading the charge. The GGRF presents a once in a lifetime opportunity to tackle the climate crisis while building an more inclusive economy. Our collective hope is that fund will pave the way for other similar public-private funding partnerships that seek to address the climate crisis.